Accountancy & Tax Advisory Services

The services you need will be determined in the first instance whether you are considering domestic or international business. Here we highlight the Accountancy & Tax Advisory Services offered by CleverAccounts (domestic) and Avalara (international).

- Domestic Services

If you think you would benefit from reviewing how your UK accountancy and tax advice services are provided, check out CleverAccounts. - providing online accounting solutions to any UK business.

- International Trade

If you are involved in international trade, then your tax requirements will be much more complex than those only involved in domestic trade. Identifying and meeting these obligations is a challenge – one that tends to grow as you do. Avalara helps your business, big or small, find the right cloud-based solution to ensure continuous compliance, no matter where you do business.

If your accountancy & tax needs are not covered by Avalara or CleverAccounts, check out the resources listed in Commercial Support Services - Accounting & Tax Advice.

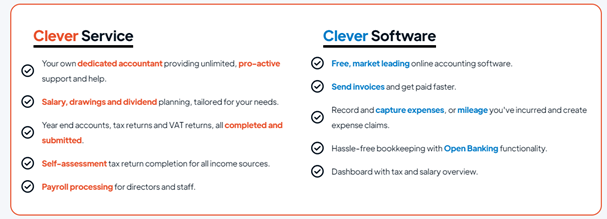

The benefits of CleverAccounts' Services and Software are perfectly balanced to provide online accounting solutions to any business with:

- Expert accountants providing unlimited support.

- Fixed fees at affordable prices.

- Saves you time and money.

Pricing packages depend upon your status and range from: £24.95+VAT to £99.50+VAT per month.

CleverAccounts also provides you with the following free resources:

Technical accountancy advice and guides on relevant articles relating to sole traders, limited companies and individuals.

Keep up with the latest accountancy and Clever news.

Check out some of their business guides on how to run and manage your business.

Check out some of their business guides on how to run and manage your business.

Avalara helps businesses of all sizes scale globally and get tax compliance right. With international tax solutions from Avalara, businesses can manage duties and cross-border tariffs, calculate VAT and GST, automate item classification for shipments, obtain registrations, and manage returns so they can grow globally and serve customers around the world. Headquartered in Seattle, Avalara has offices in the UK, Brazil, Europe, and India.

There are 4 key solutions offered by Avalara for your consideration:

- AvaTax: - Avalara's innovative, cloud-based sales tax calculation product, AvaTax, determines and calculates the latest rates based on location, item, legislative changes, regulations, and more.

- Alvara's Cross-Border Solution: - Helps solve two key pieces of the cross-border puzzle that are dependent on each other for successful transactions: mapping products to Harmonized System codes (HS codes) and calculating the customs charges.

- EU VAT Compliance:- Support merchants to understand their VAT obligations and how best to simplify their compliance process.

- Managed VAT Returns Service: - Helps companies get VAT registered and manage their ongoing VAT filing process and also supports IOSS for non-EU based traders.

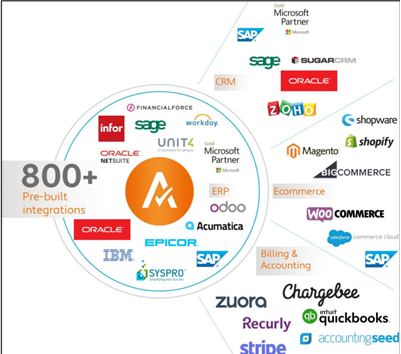

An integral part of Avalara’s services consists in their ability to seamlessly integrate into any eCommerce, ERP, CRM, Account or Point of Sales system. With close to 700+ integrations already pre-built, Avalara has the ability to connect to multiple systems and automate the calculation and filing of their transactional taxes across the globe. Below is a cross section of some of Avalara’s integrations:

For more information contact Avalara (and please mention that you were referred from here).

Avalara AvaTax is a cloud-based tax compliance solution that automates the complexities of calculating Sales Tax, VAT, GST & Customs Duties when selling globally. (For further information: see Avalara: AvaTax.)

The key characteristics of AvaTax are:

- Fast and Easy

Manually collecting sales tax and VAT can be complex and costly. When transactions cross borders, compliance gets complicated, auditing risks get serious. Avalara delivers end-to-end solutions ranging from registration and calculation to reporting and remittance.

- Accurate

AvaTax continuously updates global taxability rules, rates and boundaries for millions of products and services.

- Affordable

AvaTax is a scalable, subscription-based Software-as-a-Service (SaaS), tailored to each customer's needs. Ease and speed of integration help you go live quickly and the cloud-based service eliminates additional hardware costs.

- Adaptable

AvaTax supports all major countries, with increasingly robust content to handle complex overseas transactions. Trusted by tens of thousands of companies globally.

AvaTax Key Features

- Global calculation

International compliance made simple, with automatic rates for VAT, GST, duties and more for 193 countries around the world.

- Consumer Use Tax

Calculate one of the most difficult tax types with easy-to-use tools that can help you prevent consumer use tax mistakes at audit time.

- Landed Cost Calculation

Learn a shipment's total costs before shipping internationally, including tariffs, local taxes, and import/export duties.

- Ease of Integration

Get the power of Avalara in your shopping cart, POS, CRM, ERP and CMS software - allowing seamless calculation through all your systems.

- Returns Filing

Never miss another deadline with automated, fast returns filing and remittance - make just one payment and Avalara does the rest.

- Exemption Certificate Management

Ensure valid certificates are on hand immediately through electronic collection, storage and management making them accessible anywhere, anytime.

- Address Validation

The AvaTax calculation engine encompasses the most accurate and up-to-date address data available.

- Reporting

Generating summary and detailed reports on-demand, easily and accurately, AvaTax gives complete visibility to all transactions.

- Jurisdiction Assignment

The AvaTax service includes researched and validated system tax codes which provide highly accurate product taxability assessments and ensure the correct rates are calculated for all products and services.

- Product Taxability

AvaTax encompasses the latest information for handling destination based, origin based and hybrid sourcing rules, ensuring the most accurate possible assignment of tax rates based on individual transactions.

Avalara Returns

Using calculations from Avalara AvaTax, Returns integrates with AvaTax for optimum end-to-end automation of your sales tax calculation and remittance process. From pre-loaded calendars through filing and remittance, Avalara Returns automates your entire filing and remittance process.

- AvaTax automatically prepares and files your sales tax returns with payment on time - guaranteed.

- Retains proof of filing and payments for retention requirements and audit.

- Manages and responds to tax notices.

- Avalara files hundreds of thousands of tax returns each year on behalf of their customers.

Avalara CertCapture

Manage all your compliance documents in the cloud

Thousands of companies rely on Avalara CertCapture to gain complete control over the sales tax exemption certificate management process.

- Integrate directly with online shopping carts or customer account profile.

- Proactively manage missing, invalid and expired certificates.

- Sync with existing eCommerce, tax and order management systems.

- Lower IT costs by eliminating the need to develop proprietary solutions.

- Quickly retrieve reports and certificates in preparation for an audit.

- Remain current with state-by-state tax exemption regulations.

For more information contact Avalara (and please mention that you were referred from here).

Avalara Cross-Border is a comprehensive customs duty and import tax compliance solution built to support eCommerce and supply chain companies. Cross-Border makes it easier to sell anywhere in the world by automating the process of identifying and mapping tariff codes to products and by calculating customs duties and import taxes.

Avalara’s cross-border solution helps solve two key pieces of the cross-border puzzle that are dependent on each other for successful transactions: mapping products to Harmonized System codes (HS codes) and calculating the customs charges. Combining this with AvaTax, Avalara connects all four pieces of the global tax puzzle with a complete, unified solution.

(For further information, see Avalara: Cross-Border).

Instantly estimate customs duties and import taxes without providing upfront HS codes-

Harness the simplicity of a unified global tax platform

Avalara’s Cross-Border solution is comprised of three products:

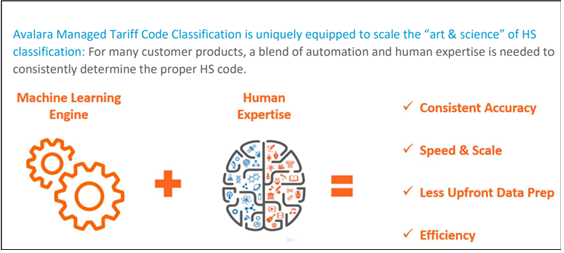

- Managed Tariff Code Classification: is uniquely equipped to scale the “art & science” of HS code classification, combining Avalara’s machine learning engine with human expertise to accurately and efficiently assign one of the world’s HS codes for the applicable country and product combination. Once a product is mapped to a HS code, customs charges can then be determined.

- AvaTax Cross-Border: calculates or estimates customs duties and import taxes in real time, accounting for treaties and helping online sellers create transparent shopping carts and reduced-friction buying experiences for their international customers.

- Trade Restrictions Management: helps international sellers learn about applicable government restrictions on selling goods across borders. This foresight facilitates more careful and effective merchandising, which can help companies reduce costs, focus their efforts on profitable transactions, and deliver a superior customer experience. This product is available using HS codes or without HS codes.

Avalara Managed Tariff Code Classification: is an artificial intelligence (AI)-based tool combined with human expertise that allows businesses to quickly and efficiently classify their product to country-specific Harmonized System (HS) codes to aid in taxability determinations for their products to other countries.

Staying on top of the thousands of HS codes – and the changes to government regulations – can be time-consuming and difficult for your employees.

Using incorrect HS codes can result in product being held in customs, even heavy fines. Having broker or shipping carrier handle your tariff code classification can lead to inflated costs and inconsistent results. Avalara’s solution provides a clearer picture, so you can make the right decisions for your business.

Avalara Managed Tariff Code Classification assigns an HS code for the applicable country. Once armed with an HS you can collect the customs duty and import taxes up front, allowing Delivery Duty Paid (DDP) shipments and improving customer satisfaction by avoiding delays and surprise charges.

- Preserve margins and reduce risk of customs delays, penalties or surcharges

- Reduce the time and resources required to manage the complexity of HS classification at any scale

- Seamless integration with AvaTax Cross-Border for a complete crossborder tax solution.

- Avalara Managed Tariff Code Classification is uniquely equipped to scale the “art & science” of HS classification: For many customer products, a blend of automation and human expertise is needed to consistently determine the proper HS code.

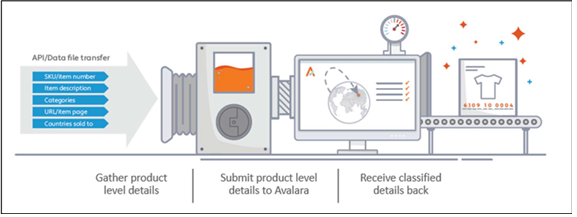

Avalara Managed Tariff Code Classification allows the assignment of a HS code based on product level information.

Avalara Managed Tariff Code Classification API allows for a custom integration, so the Tariff Code Classification engine can accept product information from business application as input and provide HS codes as output.

From independent operators to midsize businesses and Fortune 100 companies, more than 30,000 customers choose Avalara for tax compliance tools scaled to their needs.

For more information contact Avalara (and please mention that you were referred from here).

Avalara’s Managed VAT Returns Service is designed for companies that want to outsource the entire process of international VAT compliance. Avalara's low-cost Managed Returns Service helps businesses understand their obligations, gets them registered for VAT and files VAT Returns on their behalf.

Avalara Returns integrates with AvaTax for optimum end-to-end automation of your sales tax calculation and remittance process. From pre-loaded calendars through filing and remittance, Avalara Returns automates your entire filing and remittance process.

Whether providing goods and services across international borders, or shipping products abroad to an overseas warehouse or fulfillment centre, providing digital services to other businesses and consumers, or a host of other scenarios, you are likely to have a VAT burden. Understanding their Value Added Tax (VAT) or Goods & Services Tax (GST) obligations throughout the world can be incredibly complex and distracting. Avalara's service is designed to work with clients through the various stages of the international VAT journey.

(For further information see: Alvara: Managed VAT Returns Service.)

Avalara and its global partners offer:

- Specialised outsourced VAT or GST compliance.

- Access to local VAT experts that speak the national languages, and can confirm your reporting obligations in any country.

- Speedy VAT registrations and ongoing filings, Intrastat, EC Sales Listing, as well as fiscal representation and access to special VAT import deferment schemes.

- Expertise and assistance in the case of questions from the local tax authorities, including managing any audits.

Avalara ensures your business can:

- Outsource the entire VAT registration and returns process, allowing you to concentrate on your core business activities.

- Cut the cost of doing international VAT registrations and returns.

- Decrease exposure to international VAT fines and penalties.

- Gain real-time access to a web-based VAT management reporting tool, which offers full visibility over all VAT activities.

VAT Registration Services

- New Registrations

Avalara’s VAT experts will organise new VAT registrations with the minimum of effort on your behalf. Avalara is also able to deal with any VAT due or collected prior to the registration application and will work with the local tax office to determine the applicable reporting obligations.

- Transfer of Existing Registrations

Should you have any existing VAT registrations that you wish Avalara to take over, Avalara can work with your current service provider to ensure the smooth transfer of the VAT registrations.

- Deregistrations

Avalara can also offer a deregistration service where trading activities have ceased. Avalara will also act as a point-of-contact for the tax authorities should any issues come up in the future

VAT Compliance Support

Avalara ensures you are fully compliant with the national VAT laws and EU VAT Directive in each country you are registered. Avalara will ensure you are fully aware and compliant with local obligations and provide free phone and email guidance on these matters, as well as fortnightly VAT news updates. Avalara's automated VAT compliance software is used to process all your transactions through over 100 automated VAT compliance checks that ensure your treatment and calculations of VAT are accurate across all your transactions and countries.

- VAT Returns and Remittances

Avalara will closely manage your returns process with your Accounts team; detailing all upcoming deadlines and data requirements. Avalara will file returns on your behalf, and advise your Accounts team of the VAT payment details.

- Additional Declarations

In addition to VAT returns you may be required to file Intrastat and ECL declarations, and other domestic filings. Avalara's VAT software supports all EU and local filings, and Avalara's experts will work with your Accounts team to ensure all local supplementary reports are accurately prepared, reconcile to your VAT returns and go in on time.

- VAT Inspections

From time-to-time, local tax authorities will raise queries around your filings. Avalara's VAT experts can generally answer most such questions immediately based on our electronic records of your VAT transactions. In the event of a lengthy audit, Avalara will agree a budget, with associated milestones, in advance for your approval.

For more information contact Avalara (and please mention that you were referred from here).

EU VAT Registrations and Returns Services

Avalara’s VAT Reporting solution helps businesses manage their VAT Returns filing in over 50 countries.

Depending on your international activities, this can require:

- 21 different filing languages.

- Differing country VAT registration thresholds (as little as €35,000 in distance sales).

- Multiple filing formats and frequencies.

- Fundamental shift in technology processes such as e-filing, e-invoicing and SAF-T.

Avalara's solution covers the above issues and helps to increase multi-country VAT reporting accuracy while reducing dependency on manual processes and inhouse or spreadsheet-based technology. Avalara VAT Reporting integrates with ERP systems to produce compliant VAT returns and file them at the right time, where and whenever required.

Features and Benefits:

- Cloud-Based or On-Premise Options

Our solutions are flexible and offer reduced IT costs with rapid installation.

- Simple Data Collection

Use Avalara’s pre-built extractors or upload your transactions.

- Automated Data Checks

Avalara VAT Reporting uncovers errors which could lead to inaccurate returns.

- Clear Audit Path

In-depth data analysis and reconciliations across invoices, ledgers, and Intrastat provide a clear trail of changes.

- Insights with Reporting

Easy customisation of transactional data reports to suit your on-going management needs.

- Stay Up-to-Date

Our service remains up to date as tax authorities revise returns or VAT treatment legislation.

For more information contact Avalara (and please mention that you were referred from here).

Does Avalara have a solution for you?

The key question is whether you are trading internationally. Businesses trading domestically tend not to require help from Avalara. Simple domestic compliance is usually managed by internal or external accountants. Where most businesses get stuck is using the same resource and processes for managing multiple countries or different tax regimes (e.g., US sales tax, EU VAT etc.).

If you are trading internationally and would be interested to discuss how Avalara can help then please contact James Bright - on a no-obligation basis.

The initial information that: will be asked in order to have a meaningful conversation are:

- Which countries are you trading with? Do you currently sell in the US, or are you considering US expansion?

This question helps shape the solution offering.

- What channels are you currently selling on?

Most businesses have a multichannel sales strategy that often includes marketplaces. Understanding how you sell helps Avalara to advise the appropriate compliance solutions.

- What products or services do you sell?

This is important because tax rules and treatments for tangible goods, services, and digital products often vary significantly.

- Where do you have stock?

How a business manages stock has a massive impact on its tax obligations; understanding your requirements helps Avalara frame the discussion.

- What platforms (ERP, eCommerce, Point-Of-Sale) are you using in your business?

Many businesses use multiple systems to apply and calculate tax and invoice customers. With over 700 connectors to AvaTax, Avalara should have most covered, but it is good to know what they are dealing with upfront.

- Have you considered US sales tax implications and the concept of nexus?

International businesses selling in the US are not required to collect sales tax in a state unless they have ‘nexus’ a connection or business presence in a state or jurisdiction that establishes a need to collect and remit sales tax per the regulations. The activities that establish nexus vary by state and can include opening offices, stores, or franchises, storing items in warehouses, or even attending meetings or tradeshows as well as breaching economic thresholds into the US.

- How are you currently managing tax today?

Many businesses manage taxes traditionally, using manual processes. At Avalara, they help educate customers about the benefits of technology and tax automation software.

For more information contact Avalara (and please mention that you were referred from here).