Although not an insurmountable problem, you certainly need to understand whether taxes, tariffs and non-tariff restrictions are applicable and how they will affect your pricing and documentary requirements.

These are rarely straightforward and you may consider using Avalara who provide full customs duty, VAT & import tax compliance support for trade with the EU, the USA and elsewhere.

If you decide to manage the paperwork in-house, you will need to take into account:

- Any applicable tariffs.

- Non-tariff requirements.

- Tax reporting requirements.

when preparing your:

- Export pricing and documentary procedures.

- Importing considerations.

The resources indicated here will help you confront any issues you may have

We also provide below links to a number of Calculators provided by ChamberCustoms.

- UK Import Tax Calculator

- Taxes, VAT, Duties and Tariffs for Imports

- Paying Import Taxes & Duties

- Value of Goods Delivered to the UK

- VAT and Importing Goods

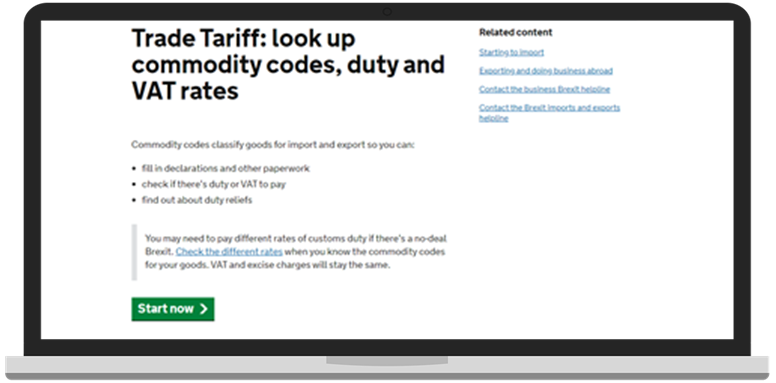

You certainly need to understand whether tariffs are applicable and how they will affect your pricing. Tariffs are payable by the importer. Therefore, whether your company will be liable for these payments depends upon whether you are the exporter or the importer. Whether tariffs are applicable and at what rate can be easily checked using online tools available via this Guide e.g. The UK Government’s Trade Tariff Look Up.

Governments use a variety of techniques other than import duties to control imports, some to limit them quantitatively (e.g. quotas); to preserve scarce foreign exchange (exchange controls); to control who can import (permitting); or to comply with health, safety or technical standards. Non-tariff barriers consist of:

- Extra documentation requirements.

- Embargoes.

- Exchange controls (limiting the transfer of foreign currency out of a country).

- Quotas.

- Sanctions.

You should research these potential non-tariff barriers (NTBs) in each target country. Again, between British Government and commercial services indicated in B2BCentral, these can all be checked (in any case, points 2 – 5 rarely apply to trade between the UK and the major, Western economies).

See also: Information Resources: Trade Reference.

EU Trade - Basic Considerations

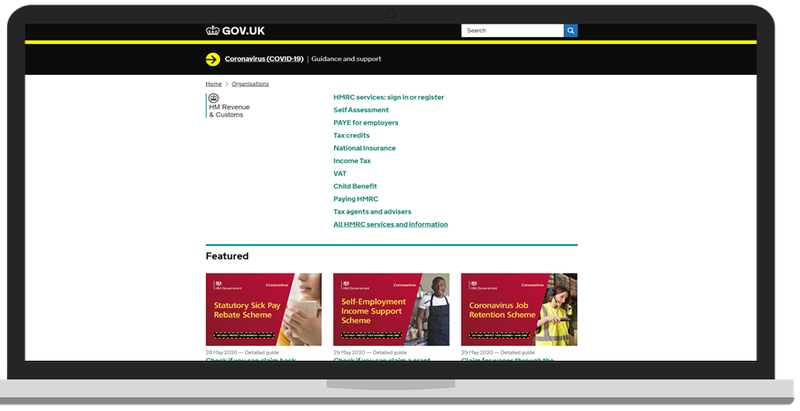

If you sell to other countries in the EU, you must keep records and submit details of these sales on your VAT return. If you have a high level of sales to EU countries, you must complete an Intrastat Supplementary declaration.

If you sell to countries outside the EU, you must keep documents that count as proof of export. These must identify:

- The exporter.

- The customer.

- The goods and their value.

- The export destination.

- The mode of transport and the route.

In both cases, most goods you export will be zero-rated for VAT. You should check with HM Revenue and Customs (“HMRC”).

An important consideration here is that you must have documentary proof that the goods have been exported and that you are therefore not liable to pay VAT on the goods. Therefore, it is recommended that you sell the goods on FOB, C&F, CIF terms - otherwise you are trusting a third party to comply with UK regulations and provide you with proof of export.

EU and International Trade - Support from Avalara

Avalara helps businesses of all sizes scale globally and get tax compliance right. With international tax solutions from Avalara, businesses can manage duties and cross-border tariffs, calculate VAT and GST, automate item classification for shipments, obtain registrations, and manage returns so they can grow globally and serve customers around the world.